If you are in search of an alternative way to pay online, rather than going with the usual one, then this will be the place. A prepaid card will be one of your practical, easy, and safe solutions!

Prepaid cards are one of the reloadable kinds of payment instruments that allow the card user to use only the value preloaded onto the card.

Unlike debit and credit cards, they do not link directly to a bank account or a line of credit. These cards indeed offer flexible financial management and are thus ideal for businesses and individuals who want better control over spending.

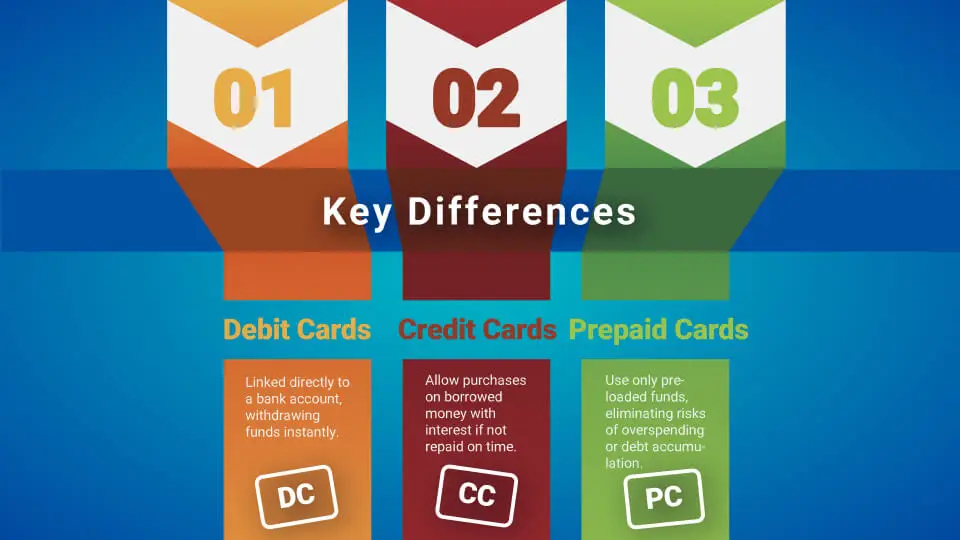

Prepaid Cards vs. Debit and Credit Cards: Key Differences

- Debit Cards: Linked directly to a bank account, withdrawing funds instantly.

- Credit Cards: Allow purchases on borrowed money with interest if not repaid on time.

- Prepaid Cards: Use only preloaded funds, eliminating risks of overspending or debt accumulation.

Mechanics of Online Payment with Prepaid Cards

Prepaid cards offer an extra layer of security and convenience for handling online payments. By preloading the money, they allow financial control and reduce risks in transactions. Below are the key steps to using them effectively.

How Does Prepaid Card Payment Work?

- Purchase or receive a prepaid card.

- Fund the card with money through bank transfers, cash deposits, or any other payment apps.

- Use the card at checkout like a debit/credit card—enter the card details to authorize the transaction.

How Prepaid Cards Facilitate Secure Transactions

These kinds of cards limit you from financial exposure because they are not linked to personal bank accounts. If compromised, the loss is confined to the preloaded amount.

For businesses, this added layer of security reduces the risk of fraud or data breaches during online transactions.

Steps Involved in Using Prepaid Cards for Online Purchases

- Load funds onto the card.

- Enter the prepaid card details (card number, CVV, expiry date) during checkout.

- Confirm payment — funds are deducted immediately.

How to pay with a prepaid card?

A prepaid credit card is a financial instrument in which you must deposit cash before you can spend through the card.

The card is subsequently utilizable to procure goods or services from any retailer that accepts credit cards.

While it functions like a debit card because it draws directly from that preloaded balance, it typically comes with higher fees and more charges, making it a less cost-effective option over time compared to traditional debit cards.

3 Benefits of Using Prepaid Cards for Online Payments

Prepaid cards are one easy way to pay online, adding security, control over spending, and access. Following are three main advantages they can offer both to individuals and businesses alike.

Maintain Security: Protecting Your Financial Information

These kinds of cards minimize risk during online payments by limiting exposure. Unlike credit cards, they are not tied to a personal credit line, and stolen funds are limited to the card balance.

Budget Control: Managing Spending Efficiently

Businesses can allocate specific funds for departments, employees, or campaigns. Prepaid cards prevent overspending by capping the available balance, fostering more disciplined financial management.

Easy Accessibility: No Bank Account Required

Prepaid cards are a great option for people and businesses that do not have access to traditional banking. They provide financial flexibility without the need for a credit check or bank account setup.

Prepaid Cards Usage for Businesses

Prepaid cards can provide companies with flexibility in terms of expenditure management, smooth operations, and increasing customer loyalty. The following are ways companies can apply prepaid cards effectively.

Using Prepaid Cards for Employee Expenses and Travel

These cards help the business manage employee travel, office supplies, and project budgets. They make tracking easier and cut administrative overhead by avoiding reimbursements.

Incentives and Promotions: Increasing Customer Engagement

These cards may be distributed by companies as part of incentive programs, rewards programs, or promotions. An effective way to boost customer loyalty and engagement, they offer practical value.

Virtual Prepaid Cards: The Future of Online Payments

Virtual prepaid cards are an up-to-date solution to online payments, offering the ease of digital access and yet more security. They will be designed to handle smooth online transactions and be flexible for many use cases.

Understanding Virtual Prepaid Cards: Benefits and Use Cases

Virtual prepaid cards are digital versions of physical cards, offering the same benefits but designed for online transactions. They are secure, reloadable, and ideal for:

- Online subscriptions

- E-commerce purchases

- Employee expense management

How Virtual Cards Simplify Online Shopping Experiences

Virtual prepaid cards streamline online shopping by:

- Enabling quick and secure payments

- Protecting sensitive financial information

- Providing easy reload options for recurring payments

What to Consider: Fees, Expiration, and Usage Restrictions

While prepaid cards are highly advantageous, users should consider:

- Fees: Activation, reload, and maintenance fees may apply.

- Expiration: Some prepaid cards expire after a certain period, requiring reissuance.

- Restrictions: Certain prepaid cards may have limited online usability or geographic restrictions.

Common Concerns About Prepaid Cards

- Do Prepaid Cards Expire and What Happens After?

Those cards have an expiration date, but funds may transfer to a new card upon renewal. - How to Reload a Prepaid Card?

Reload options include bank transfers, payment kiosks, or partner networks. - Why Don’t Prepaid Cards Work Online?

Some websites may not accept These kinds of cards due to merchant restrictions or insufficient balance.

Choosing the Right Prepaid Card for Your Needs

To choose the best-prepaid card, consider:

- Fees and charges (activation, reload, monthly maintenance)

- Reload options (online, physical locations, mobile apps)

- Usage restrictions (regional limits or online compatibility)

Top Prepaid Card Providers and Their Offerings

Explore prepaid card solutions from reputable providers offering:

- Competitive fees

- Wide usability for online payments

- Virtual card options for seamless digital transactions

Manage Your Budget Easily with a Prepaid Card

With a prepaid card, you can only spend the amount you’ve loaded onto it—no risk of overspending. Use the mobile app to check a detailed transaction history and receive real-time alerts to monitor your expenses.

This straightforward approach simplifies budget management and keeps your finances in check, avoiding unexpected surprises.

Who Benefits Most from the Card?

Take a young entrepreneur just starting out, without a credit history, getting a traditional credit card can be tricky. The prepaid card lets them manage business expenses like subscriptions and supplier payments effortlessly. Or consider an international student—this card allows easy transfers, helping them stay on top of their budget while studying abroad.

Whether you’re a freelancer, expatriate, foreign student, or simply need a flexible payment solution, the prepaid card is a practical, secure option for modern financial needs. It streamlines online transactions and works seamlessly with today’s digital lifestyle.

Are Prepaid Cards Suitable for Online Gaming and Subscription Services?

Yes, These kinds of cards are ideal for subscription services, online gaming, and digital purchases. They help users manage recurring costs while preventing unexpected charges by capping spending limits.

Conclusion

Prepaid cards offer businesses and individuals a reliable and secure way to manage online payments. By providing enhanced financial control, budget management, and fraud protection, These kinds of cards simplify transactions for modern businesses.

As virtual cards continue to gain popularity, businesses can further streamline online expenses while improving customer loyalty through incentive programs.

Start exploring the benefits of These kinds of cards today with HKS Global Group to simplify your financial management and secure your online payments!

FAQs

Do Prepaid Cards Expire and What Happens After?

Yes, These kinds of cards can expire, but users can often transfer funds to a replacement card.

How to Reload a Prepaid Card?

You can reload via bank transfers, cash payments at partner locations, or mobile wallet apps.

Why Don’t Prepaid Cards Work Online?

Some merchants may restrict prepaid card usage. Ensuring sufficient balance and verifying card details can resolve this issue.

Maria

I'm a Fintech & Digital Distribution Writer. I do create engaging content on B2B solutions, gift cards, eSIMs, and prepaid services and more. I provide tailor-made solutions that empower businesses and consumers.